OPINION: Financially illiterate Bulls need help and USF should step up

“WTF is a Roth IRA?” a senior who responded to The Oracle’s Jan. 31 survey wrote. And she’s not the only student wondering.

Upon graduation, many students feel ill-equipped to financially navigate the ‘real world.’ Many common practices have become foreign to students: budgeting, filling out a W2 and even balancing a check.

And many feel they are entering the professional world blindly.

Universities can do more to help students better understand the life skills that will haunt them in their daily lives post-graduation: finances and budgeting.

“If I make more than I spend I should be okay. I think,” a sophomore survey respondent wrote.

As young adults making their way through college, only 53% of 30,000 said they feel prepared to manage finances, according to a 2019 survey by EVERFI.

It’s too easy to fall victim to the financial stress caused by being undereducated during college studies.

USF should promote financial literacy by adding personal finances classes to the general education curriculum.

Financial literacy would teach students many professional skills:

- Balancing a checkbook

- Managing credit scores

- Computing federal income taxes

- Completing loan applications

The course would encourage students to become more thoughtful and understanding of their finances – which USF should encourage.

“Financial literacy is a skill that every person ought to be familiar with, especially college students,” said Daniel Bradley, a USF finance professor. “It makes complete sense for the course to be added to the core curriculum.”

Bradley is a proponent for financial literacy courses. Back in 2015, he pushed for such a course to be added to USF’s core curriculum.

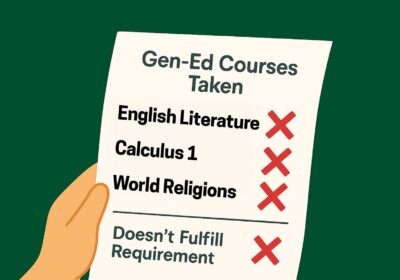

“There’s a lot of politics that go into adding to the general education curriculum. With a fixed number of courses, if something was added then another course would have to be removed,” Bradley said. “I didn’t win that battle.”

Financial illiteracy is a growing epidemic in the U.S. with Florida being ranked the 38 worst state for financial literacy.

Adding a personal finance course to the core curriculum would benefit USF students by teaching them how to manage and identify financial problems before these issues become crises.

Initiatives to combat this have occurred at high school levels. Florida Senate Bill 1054 now requires students to take half a credit of a financial literacy class prior to graduation. This introductory course only covers the basics and does not fully prepare high school students for a lifetime of money management.

“I took a financial literacy class in high school but it didn’t give me a great understanding of tackling loans and credit card debt,” a junior wrote. “I don’t have a deep understanding of finances, only a basic level.”

S.B. 1054 excludes a more financially vulnerable demographic. 42 million college students in America have taken out a loan for university – they should be the target audience for financial literacy courses.

Financial literacy is an issue that should be taught at a postsecondary level. Many students take out a loan to complete college and need to be aware of how to go about paying off student debts.

“Students come out of college and find out they are significantly in debt,” Bradley said. “When it comes to student loans and things of that nature, I do think it’s the duty of universities to make sure that students know what they are getting into.”

Online resources provided by USF are readily available for students who want to further their financial education. Students can access financial help during spare time, which is a more optimal and cheaper way of learning for some.

“I don’t want to pay tuition for another general education class,”a freshman who responded to the survey wrote. “This is valuable information but I would rather have learned in high school or on my own for free.”

The benefits of financial literacy as a general education course would outweigh the tuition costs. It’s better to be over-prepared for life outside of university – if there’s even such a thing – than to be incompetent and lacking understanding of your finances.

Universities should implement such courses as required since college loans are the main reason that many students feel they are in a ‘financial crisis.’

Students need to be able to navigate loans and are entitled to being hopeful about their professional future. USF’s current general education which excludes financial literacy is failing students in ways that will hurt them in the long run.