OPINION: Bills improving student loan process need to be prioritized by Congress

As Americans reached a new high of $1.7 trillion in student loans in May, according to the Federal Reserve, three bills proposed by a group of U.S. senators in April to simplify the financial aid process for college students come at the perfect time.

Minnesota Democratic Sen. Tina Smith and Iowa Republican Sens. Chuck Grassley and Joni Ernst reintroduced the Understanding the True Cost of College Act and the Net Price Calculator Improvement Act while debuting the Know Before You Owe Federal Student Loan Act.

These bills should be passed to combat the lack of financial literacy coupled with crushing student debt in the U.S. These bills will brief young people on their loan options and consequences through standardized information, counseling and accurate payment calculations. These elements are integral to informed decisions about their financial future.

The first bill, Understanding the True Cost of College Act, will boost financial literacy by helping students understand the terms they agree to when applying for loans through the use of a simplified, standardized format.

The secretary of education is required by the act to work with colleges, families and students to relay information to borrowers as clearly as possible. For instance, certain disclosures in a school’s financial aid offer will be necessary, including options to borrow less or more than recommended with a link to and an explanation of the U.S. Department of Education’s Loan Simulator repayment calculator.

This must all be stated “in a consumer-friendly manner that is simple and understandable,” according to the proposal. This includes certain language that must be used in relation to loans, like clear use of the word “loan” and explicit labeling of federal subsidized and unsubsidized loans.

Young people in the U.S. are largely financially illiterate. The 2018 FINRA National Financial Capability Study asked 30,000 participants five questions covering everyday aspects of economics and finance, like the effects of basic interest and inflation. Only 17%, or 552, of the 3,250 18- to 34-year-olds surveyed were able to correctly answer the majority of the questions.

With simplified language and explanations, college students and their families will have a greater understanding of how taking on a loan can impact their financial future, and can thus make more informed decisions with reference to their financial situation.

The proposed bills will also make college more accessible for students from low-income families.

Financial literacy is highly correlated with income, with individuals in the highest-income quartile scoring 27% higher financial literacy on average than the lowest income quartile in a study by the Federal Reserve Bank of St. Louis.

This is no surprise, as income is highly correlated with higher education. With low income and low financial literacy, many families assume they simply cannot afford college.

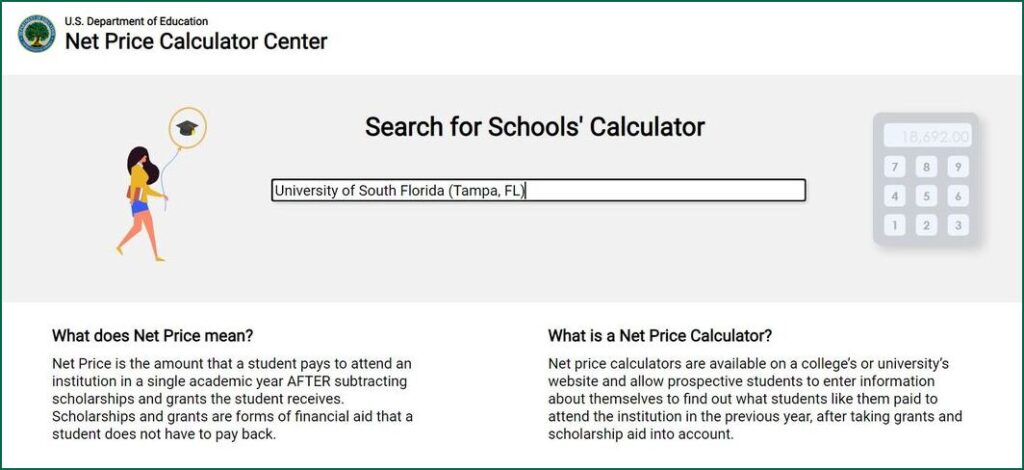

The second bill, the Net Price Calculator Improvement Act will amend the Higher Education Act of 1965 to improve the Net Price Calculator, which shows students their cost of college after financial aid that doesn’t need to be repaid, such as grants, tuition waivers or scholarships by the school.

By looking at net price rather than general tuition, students from low-income families may discover schools they thought were too expensive may be within reach.

The Know Before You Owe Federal Student Loan Act, the third bill, will improve federal loan counseling by requiring loan counseling and educational modules for every student who borrows federal loans.

Together, these bills will empower students from low-income families to take charge of their financial futures by providing easily accessible and readable resources to educate them on practical loan choices.

USF has already implemented some of these steps. Students who are receiving a direct loan for the first time are required to complete entrance counseling regarding the loan. All first-year students at USF are also required to complete a financial wellness module before the semester begins. The module provides financial resources to students through the Office of Financial Aid.

The proposed legislation should be supported by the people and our representatives. Nothing ever came of the Cost of College Act when it was first introduced in 2017, a mistake that should be amended this time around. All the bills have also sat in limbo for the past two months in a committee. They need to be immediately prioritized and passed as students return to school and have to start making financial choices to pay for it.

Financial illiteracy and student debt are at a record high in America. By making student loan information and options more accessible to students and their families, young people are better equipped to take charge of their financial futures, rather than fall victim to financial ignorance.