Study of college value overlooks setbacks after graduation

Every now and then, college students are reminded why a degree is still worth the trouble and cost.

It could be out of fear that some college students fantasize about leaving school to become a highly-paid success story or pursue the Thiel Fellowship, which awards $100,000 to people under age 20 who leave school for two years to become an entrepreneur.

Still, most college students have some sort of goal in mind when making the time and financial commitment to go to school. Studies continue to be conducted to figure out the value of attending college to assure students their efforts will be promising.

Out of the most recent attempts to do so, a study published by the Federal Reserve Bank of San Francisco takes the cake for being the most overly exaggerated.

According to the study, after considering the cost of tuition and the approximate four years of earnings lost as one gets his degree, the average college graduate in the U.S. will have earned at least $800,000 more than the average high school graduate by retirement.

It also found that students who pay $21,200 in tuition per year will make up the amount by age 38 and that 90 percent of students at public colleges pay less than that.

In the long term, the study actually paints a decent picture of the rewards a college graduate will eventually make within the relatively short amount of time they went through college.

But in the short term, many college students face immediate setbacks that show the rewards of a degree might not come to fruition until much later in life.

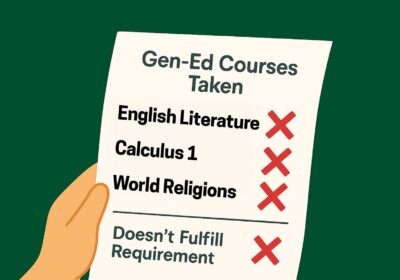

For instance, a report by the Federal Reserve Bank of New York found that about 44 percent of recent graduates, or those between the ages 22 to 27 with a bachelor’s or above, are in jobs that don’t require a bachelor’s degree. The article indicates this number has not changed much since the 1990s, but most of the jobs these graduates are overqualified for pay less than before, with salaries under $45,000.

Additionally, a report by the Economic Policy Institute (EPI) stated the unemployment rate for college graduates between age 21 and 24 is about 8.5 percent, a startling amount for many who are just getting on their feet after graduation.

While the San Francisco study accounted for the expense of college by calculating the time it takes to make back the cost of tuition, not student loan debt, certain life choices a graduate makes are still affected by having to pay for college, as discussed in a recent New York Times article.

For example, the article mentions fewer adults between the ages of 27 and 30 with student loans have mortgages than those who don’t have student loans. Student loan debt also reduces the chances of one seeking a low-paying public-interest job such as teaching, according to a study conducted by faculty and staff members at the University of California, Berkeley and Princeton.

Of course, studies such as the San Francisco Fed’s and data from the EPI, such as the finding that those with four-year degrees, on average, make 98 percent more per hour than those without a degree, do illustrate the monetary value of college to students and graduates.

Though they may help college students sleep better in light of the immediate economic climate and impact of student debt, these realities should not be forgotten when considering college’s rewards.

Isabelle Cavazos is a junior majoring in English and Spanish.